kentucky inheritance tax calculator

There are a total of 120 counties in the state of Kentucky and each county houses a different tax rate. The tax rate is the same no matter what filing status you use.

A Guide To The Federal Estate Tax For 2022 Smartasset

Kentucky is one of the states that underwent a tax revolution in 2018 making its tax rates much easier to follow and learnSince 2018 the state has charged taxpayers with a flat income tax.

. Affiant further states that a Kentucky Inheritance Tax Return will not be filed since no death tax is due the state and a Federal Estate and Gift Tax Return Form 706 is not required to be filed. States levy inheritance tax on money and assets after theyre already passed on to a persons heirs. 6 of amount over.

The inheritance tax is not the same as the estate tax. The highest property tax rate in the state is in Campbell County at 118 whereas the. Kentucky is a reasonably friendly tax state.

Class b beneficiaries are subject to an inheritance tax ranging from 4 to 16 class c beneficiaries are subject to an inheritance tax ranging from 6. It must be filed within 18 months of the. Youll pay taxes based on the amount of your inheritance not the value of the entire estate.

Affiant further states that a Kentucky Inheritance Tax Return will not be filed since no death tax is due the state and a Federal Estate and Gift Tax Return Form 706 is not required to be filed. An Affidavit of Exemption will be accepted for the final settlement and closing of the. Kentucky has an inheritance tax ranging from 4 to 16 that varies based on.

Kentucky imposes a flat income tax of 5. Class A beneficiaries pay no taxes on their. Overview of Kentucky Taxes.

Sary to file an Inheritance Tax Return with the Kentucky Department of Revenue DOR. Aside from state and federal taxes many Kentucky. The Kentucky inheritance tax is a tax on the right to receive property upon the.

Failure to File or Failure to Furnish Information - Five 5 percent of the estimated tax due assessed by the Department of Revenue for each 30 days. This inheritance tax is only levied against the estates of residents and nonresidents who own property in Kentucky. The minimum penalty is 25.

Your household income location filing status and number of personal. Inheritance and Estate Taxes KRS 140010 et seq Inheritance tax 416 percent. Like most other states that impose this tax the Kentucky inheritance tax rates are straightforward and easy to understand.

Inheritance and Estate Taxes KRS 140010 et seq Inheritance tax 416 percent. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Historical Kentucky Tax Policy Information Ballotpedia

Kentucky Estate Tax Everything You Need To Know Smartasset

Is There A Federal Inheritance Tax Legalzoom

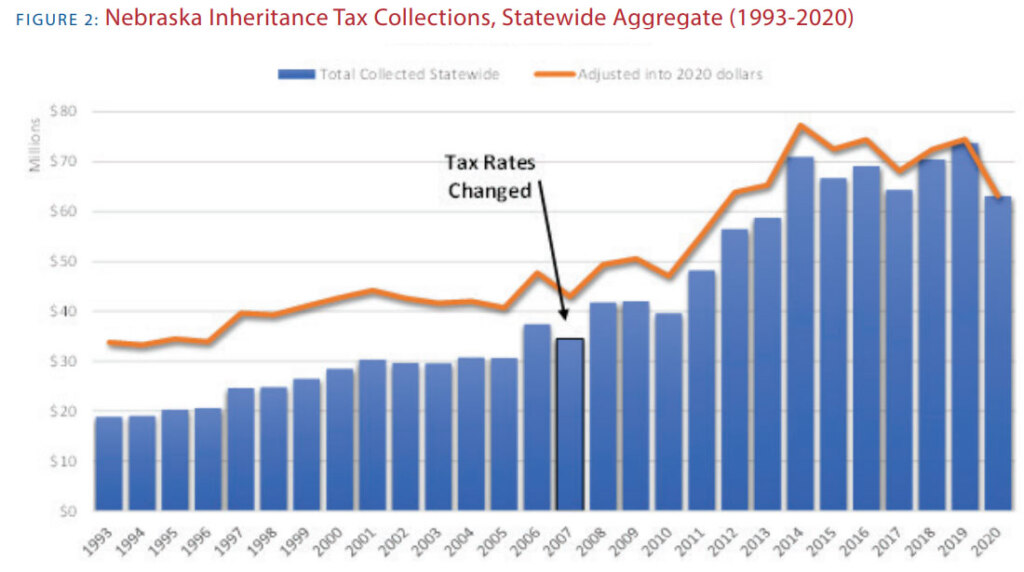

Death And Taxes Nebraska S Inheritance Tax

Estate Inheritance Tax Threshold Rates Calculating How Much You Owe

How To Calculate Inheritance Tax 12 Steps With Pictures

Estate Inheritance Tax Threshold Rates Calculating How Much You Owe

What S The Difference Between An Estate Tax And An Inheritance Tax Phelps Laclair

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Your State Have An Estate Or Inheritance Tax

Estate Tax In The United States Wikipedia

Is There An Inheritance Tax In The Usa Expat Tax Professionals

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

How To Pay Inheritance Tax With Pictures Wikihow Life

:max_bytes(150000):strip_icc()/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group