sales tax calculator anaheim

Method to calculate Orange County sales tax in 2021. Sales Tax Amount Net Price x Sales Tax Percentage 100 Total Price Net Price Sales Tax Amount.

Who Pays The Transfer Tax In Orange County California

Request proper tax documents from the customer or the state necessary to process tax credit to.

. Sales Use Tax Specialist. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Find your California combined state and local tax rate.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Did South Dakota v. Ad Lookup Sales Tax Rates For Free.

Wayfair Inc affect California. The current total local sales tax rate in Anaheim CA is 7750. Anaheim hidden hotel taxes.

The current total local sales tax rate in Tustin CA is 7750. Fill in price either with or without sales tax. Wine cider or spirits youre likely going to need some type of beverage alcohol license.

The minimum combined 2022 sales tax rate for Anaheim California is. Real property tax on median home. Santa Fe Springs CA.

Room Rates should have a base then they might add a resort fee and then other fees such as parking. Sales Tax State Local Sales Tax on Food. Local tax rates in California range from 015 to 3 making the sales tax range in California 725 to 1025.

The California sales tax rate is currently. This is the total of state county and city sales tax rates. The 775 sales tax rate in Anaheim consists of 6 California state sales tax 025 Orange County sales tax and 15 Special tax.

175 lower than the maximum sales tax in CA. And yes most Hotels I know when I book shows me the base rate then the total including all. 25 - 27 Per Hour Employer est Easy Apply.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. You can print a 775 sales tax table here. The County sales tax rate is.

Anaheim CA Sales Tax Rate. For tax rates in other cities see California sales taxes by city and county. Our sales tax calculator will calculate the amount of tax due on a transaction.

There is base sales tax by California. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Anaheim California and Dallas Texas.

The 775 sales tax rate in Anaheim consists of 6 Puerto Rico state sales tax 025 Orange County sales tax and 15 Special tax. The calculator can also find the amount of tax included in a gross purchase amount. The Anaheim sales tax rate is.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. 2022 Cost of Living Calculator for Taxes. The mandatory local rate is 125 which makes the total minimum combined sales tax rate 725.

There is no applicable city tax. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. US Sales Tax California Orange Sales Tax calculator Anaheim incorporated.

Counties cities and districts impose their own local taxes. Interactive Tax Map Unlimited Use. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

Decide what drinks your business plans to sell and learn the licenses you need. For tax rates in other cities see Puerto Rico sales taxes by city and county. Look up the current sales and use tax rate by address.

Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property and. The base state sales tax rate in California is 6. The December 2020 total local sales tax rate was also 7750.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Your Anaheim cafe or restaurant may require a general license for all types of alcoholic beverages or a license just for beer and wine. 226 sales tax Jobs in Anaheim CA.

The results are rounded to two decimals. There is no applicable city tax. Then the Hotel TOT tax of 17 sometimes broken down to a 15 base tax and a 2 Resort District Tax.

Calculate sales tax Free rates. Calculator for Sales Tax in the Anaheim incorporated. CA Sales Tax Rate.

The average sales tax rate in California is 8551. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Anaheim CA. You can print a 775 sales tax table here.

Food And Sales Tax 2020 In California Heather

California Sales Tax Rates By City County 2022

Use This Sales Tax Calculator To Figure Sales Tax Or Vat Gst At A Rate Of 7 Free To Download And Print Tax Printables Sales Tax Tax

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

California Income Tax Rapidtax

Understanding California S Property Taxes

Anaheim California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

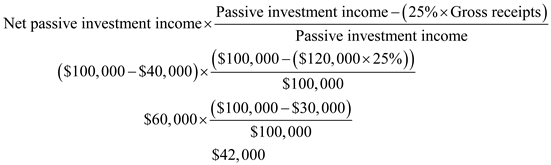

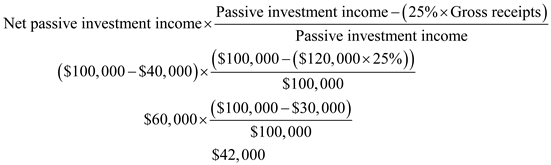

Solved Calculate Anaheim Corporation S Excess Net Passive Income Chegg Com

Food And Sales Tax 2020 In California Heather

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Anaheim Ca Tax Preparation And Planning Anaheim Income Tax

Understanding California S Property Taxes

Food And Sales Tax 2020 In California Heather

Sales Tax Anaheim Tax Services Ca